Get the free t480 form

Show details

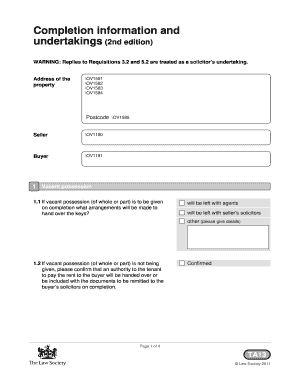

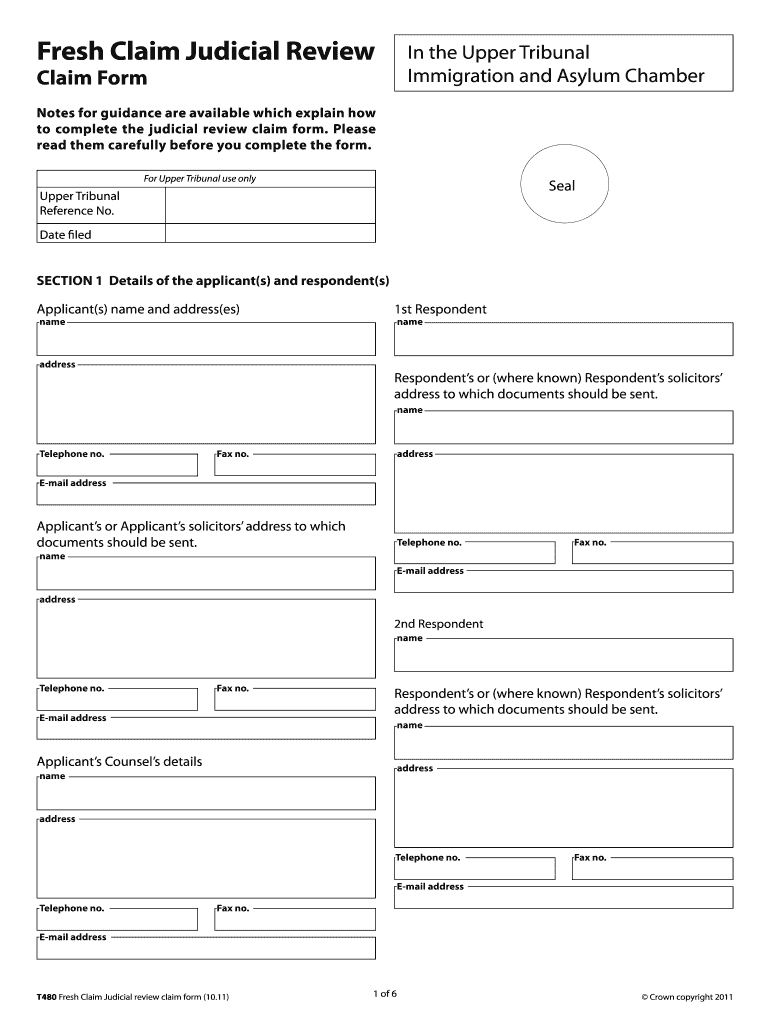

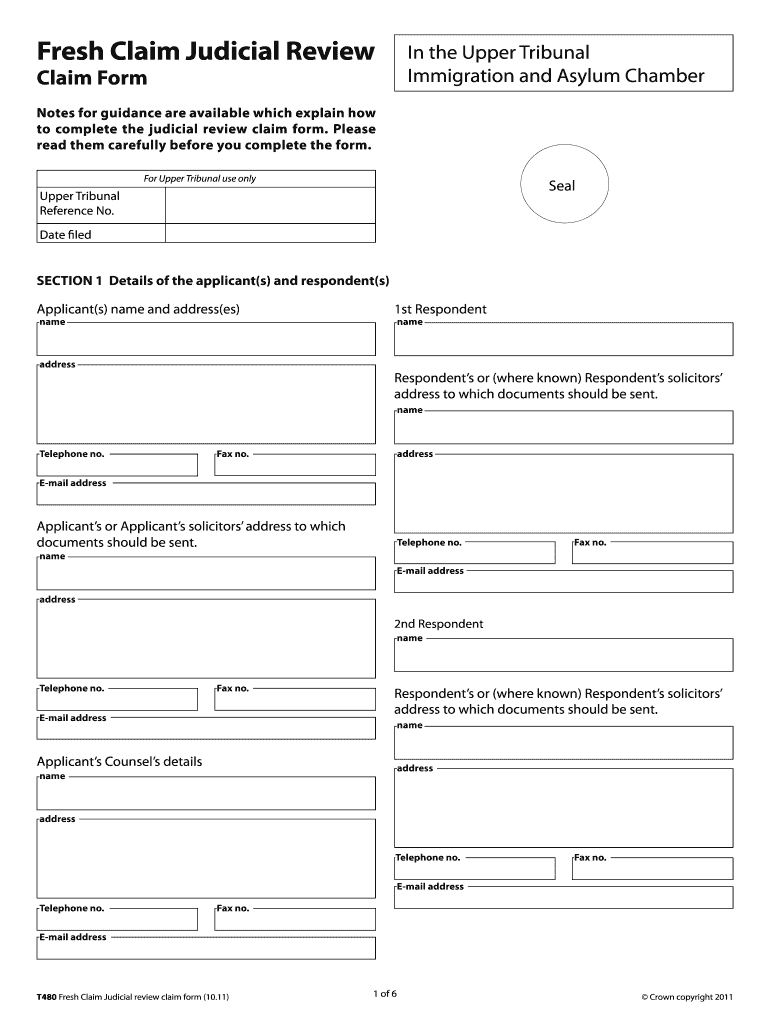

2nd Respondent Applicant s Counsel s details 1 of 6 T480 Fresh Claim Judicial review claim form 10. Fresh Claim Judicial Review Claim Form In the Upper Tribunal Immigration and Asylum Chamber Notes for guidance are available which explain how to complete the judicial review claim form. Please read them carefully before you complete the form. For Upper Tribunal use only Seal Reference No. Date filed SECTION 1 Details of the applicant s and respondent s Applicant s name and address es name...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your t480 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t480 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t480 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dclaim form 100 claimfor crime. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out t480 form

How to fill out form t480?

01

Firstly, gather all the necessary information and documents required to complete form t480. This may include personal details, financial information, and any supporting documentation.

02

Start by carefully reading the instructions provided with form t480. Familiarize yourself with the purpose of the form and any specific requirements for filling it out.

03

Begin filling out the form by entering your personal details accurately. This may include your full name, address, contact information, and other relevant identification details.

04

Move on to the financial section of the form. Provide the required information regarding your income, assets, debts, or any other financial details as requested on the form.

05

If there are any additional sections or questions on the form specific to your situation, be sure to complete them accurately and thoroughly. Double-check that all the information provided is correct and complete.

06

Once you have filled out the form, review it carefully to ensure there are no errors or omissions. Make any necessary corrections or additions before proceeding.

07

Sign and date the form in the designated areas as required. This may involve providing additional authorizations or consents, depending on the purpose of form t480.

08

Finally, prepare any supporting documents that need to be attached to the form. Ensure they are organized and clearly labeled to avoid any confusion.

Who needs form t480?

01

Individuals who are applying for a specific benefit or service that requires form t480 may need to fill it out. It is essential to check the specific requirements of the application or process to determine if form t480 is necessary.

02

Form t480 may also be required by certain institutions or organizations as part of their internal processes. This could include employers, financial institutions, or government agencies.

03

It is recommended to consult the relevant authorities or institution to confirm if form t480 is required in a particular situation. They can provide accurate guidance on who needs to fill out the form based on specific circumstances.

Fill t480 form judicial review : Try Risk Free

People Also Ask about t480 form

How much does a judicial review cost UK?

What is key difference between judicial review in the US and the UK?

What is the judicial review process in the UK?

What is the time limit for judicial review in the UK?

How long does judicial review take in UK?

How to apply for judicial review UK visa?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form t480?

Form T480 is a Canadian tax form used to report resource taxation for the taxation year. It is specifically for taxpayers who have received investments in flow-through shares and qualified investments by provincially-registered mining corporations. This form is used to calculate and report any deemed disposition, recapture, and deductions related to these investments.

Who is required to file form t480?

Form T480 is required to be filed by individuals who are claiming the federal adoption expense tax credit in Canada.

How to fill out form t480?

Form T480 is used by individuals who wish to claim a deduction for a previous year's capital gains or election out of the 60-month capital gains reserve. Here is a step-by-step guide on how to fill out the form:

1. Begin by providing your personal information in the top section of the form. This includes your name, social insurance number, and current address.

2. Move on to Part 1 - Calculation of Amounts to Transfer. In this section, you need to provide details about the capital gains you realized in the previous year, the year you want to apply the deduction to, and the amount of capital gains reserve balance you wish to claim.

3. Calculate the amounts to be transferred from the Adjusted Cost Base (ACB), Proceeds of Disposition, and Outlays and Expenses. Fill in these amounts in the appropriate boxes.

4. If you received capital property as a gift or inheritance, you may have to reduce your capital gains. Complete the required calculations in Part 2 - Reduction of Capital Gains.

5. Next, proceed to Part 3 - Calculation of Capital Gains Deduction. Input the eligible capital gains deduction you wish to claim on line 460 of your federal Schedule 3. Complete the calculations as instructed to determine your allowable capital gains deduction.

6. Lastly, in Part 4 - Calculation of Part XII.2 Tax (60-month capital gains reserve), you need to include the amounts previously claimed and the result of your calculations.

7. Complete the Certification section at the bottom of the form, ensuring you sign and date it.

Remember to review your completed form for any errors or omissions before submitting it to the Canada Revenue Agency (CRA). It is also recommended to consult with a tax professional for any specific questions or concerns related to your tax situation.

What information must be reported on form t480?

Form T480 is related to the Self-employed Business, Professional, Commission, Farming, and Fishing Income. It is used to report the income and expenses for self-employed individuals in Canada. The information that must be reported on this form includes:

1. Personal information: Your name, social insurance number, and contact details.

2. Gross professional income: The total amount you earned from your self-employment activities before deducting any expenses.

3. Gross farming fishing income: The total amount you earned from farming or fishing activities before deducting any expenses.

4. Gross commission income: The total amount you earned from commission-based work before any deductions.

5. Gross business income: The total amount you earned from your business activities before deducting any expenses.

6. Net income: The amount of income you earned after deducting all allowable business expenses from your gross income.

7. Expenses: Detailed breakdown of the expenses you incurred in generating your self-employment income, such as vehicle expenses, business-related travel expenses, office expenses, advertising expenses, etc.

8. Capital cost allowance: If you have claimed any capital cost allowance for depreciable property used for your self-employment activities, you need to report it here.

9. Partnership income: If you are a partner in a business, you need to report your share of the partnership income.

10. Foreign income: If you earned any income from foreign sources, you need to report it separately.

11. Social benefits repayment: If you received any social benefits (such as EI or CPP benefits) that you have to repay, you may need to report the repayment amount.

12. Provincial or territorial taxes: Some provinces and territories have their own tax rates and credits, and you may need to report the amounts specific to your province or territory.

It is advisable to consult the Canada Revenue Agency (CRA) or a tax professional for accurate guidance and specific requirements when completing form T480.

How do I complete t480 form online?

Filling out and eSigning dclaim form 100 claimfor crime is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the t480 claim in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your t480 judicial review in minutes.

Can I create an eSignature for the t480 claim form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your t480 judicial form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your t480 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t480 Claim is not the form you're looking for?Search for another form here.

Keywords relevant to t480 judicial form

Related to judicial review claim form upper tribunal immigration

If you believe that this page should be taken down, please follow our DMCA take down process

here

.